Siemens Gamesa will install wind turbines in Sweden that operate up to 6.6 MW but wider deployment and larger units will require transport and permitting solutions, industry experts told New Energy Update

As thirst for lower-cost drives turbine capacities higher, three recent deals in Sweden have pushed turbine capacities into new territory.

In December, Siemens Gamesa signed a deal to supply 35 of its 5.8-155 turbines to Foresight Group’s 231 MW Skaftasen project in central Sweden. Foresight acquired the project from developer Arise in 2019.

The turbines have a rated capacity of 5.8 MW and will operate with a flexible power rating of 6.6 MW, a capacity only previously seen on offshore projects. Since the Skaftasen deal, Siemens Gamesa has agreed to supply similar turbines to Eurowinds’ Knostad project and Renewable Energy Systems’ (RES) Rodene project, also in Sweden.

Siemens Gamesa’s latest turbine platform uses the largest rotor diameters on the market, at 155 meters and 170 m, boosting performance in high, medium, or low wind conditions.

Based on a wind speed of 8 m/s, the SG 5.8-155 turbine increases annual energy production (AEP) by 20% compared with SG 4.5-145. At wind speeds of 7 m/s, the SG 5.8-170 boosts AEP by more than 32%.

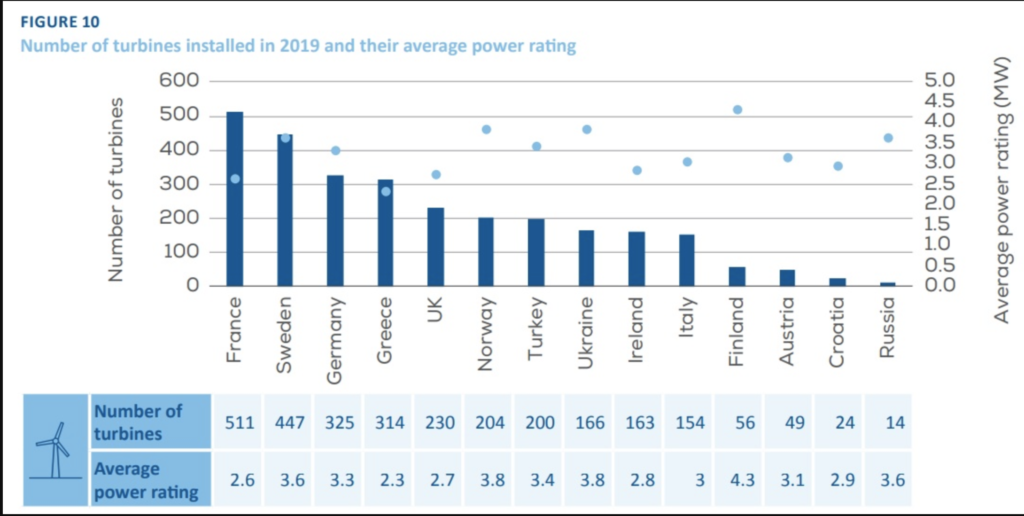

Average power rating of onshore turbines installed in 2019

Source: WindEurope

Larger, higher efficiency turbines increase performance by accessing untapped wind resources and reducing cost per MW installed.

However, a sharp rise in turbine capacities brings fresh design, transport logistics and permitting challenges. The potential for future turbine sizes will depend on how companies mitigate these risks.

“There is an incredible amount of ingenuity in the industry,» Enrique Pedrosa, Chief Regions Officer for Siemens Gamesa’s Onshore business unit, told New Energy Update.

Siemens Gamesa is the largest supplier of offshore turbines and its offshore team is already working on rotor diameters longer than 200 m, Pedrosa said.

«The real question is how much blades can grow to make the higher energy production worth more than the costs increases,» he said.

Higher winds

Wind turbine costs have fallen sharply over the last decade and project partners face further cost pressures as the industry develops.

“As the world shifts towards unsubsidized renewables there is a clear need for projects to be viable on their own economic basis,” Daniel Cambridge, Senior Investment Manager, Foresight Group, said.

“Turbine installation costs typically make up the lions’ share of CAPEX, and can have a material bearing on whether a project will reach the final investment decision stage,” he said.

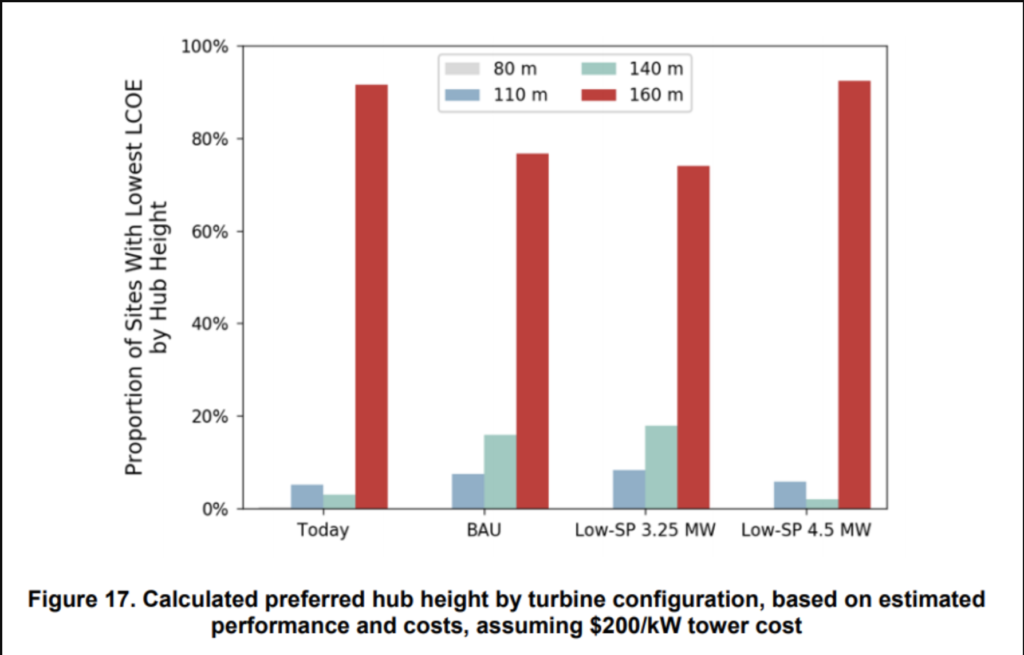

Taller towers have a profound impact on project economics, particularly for moderate wind areas, the US National Renewable Energy Laboratory (NREL) said in a report last year.

Eurowinds’ Knostad project is located in an area of forest and will feature tower heights of 115 m with rotor lengths of 170 m. Siemens Gamesa offers tower heights up to 165 m.

An increase in tower height from 80 m to 160 m raises the average wind speed by 1.0 to 1.5 meters per second (m/s), NREL said in its report. Median capacity factors rise by 2 to 4% between 80 m and 110 m and climb by 2 to 4% from 110 m to 140 m and a further 1% from 140 m to 160 m, it said.

Taller tower heights could reduce capital costs to «less than $500/kW for low specific power turbines and potentially as low as $200/kW, particularly for higher specific power turbine configurations,” NREL said.

Preferred hub height by turbine configuration

Source: NREL report ‘Increasing Wind Turbine Tower Heights: Opportunities and Challenges’, May 2019.

Tailored turbines

To boost the capacity of commercial turbines, designers must minimize the cost impact along the full length of the supply chain. Incremental cost increases include «new components, supply chain development, logistics,” Pedrosa said.

Longer lifespans are also key to minimizing costs and larger capacities put greater pressure on plant reliability. Suppliers of key components such as gearboxes are upgrading products to accommodate higher loads and adapting designs to improve maintenance efficiency.

Turbine developers have also introduced more flexibility into their designs to provide a more tailored solution for operators. Siemens Gamesa’s 170 m model is designed for low and medium wind conditions and the 155 m model for medium and high wind conditions. For RES’ Rodene project, Siemens Gamesa will supply two different tower heights.

For the Skaftasen project, the turbines will be delivered in cold climate version, capable of withstanding -40°C and operating at temperatures as low as -30°C. Siemens Gamesa has signed a 30-year full-service agreement with the owner.

Transport squeeze

Growing turbine dimensions have presented significant transport challenges in Europe and the US.

In the US, blades longer than 55 meters typically require special trailers and escorts, increasing transport times and costs.

To minimize transport risks, GE Renewable Energy has launched a two-piece blade design that can be assembled on site.

«All the leading manufacturers are working on split-plate technology,” Shashi Barla, Principal Analyst, Global Wind Supply Chain and Technology at Wood Mackenzie Power & Renewables, said.

Segmented designs will be widely commercially deployed over the next few years, he said.

US transport limits also restrict turbine towers to a diameter of around 14 feet (4.3 m), limiting conventional one-piece tower designs to around 80 m in length.

New tower designs could unlock these constraints. US group Keystone Tower Systems is developing an on-site spiral welding process that could allow hub heights of over 180 m. The Department of Energy (DOE) has awarded Keystone $5 million to demonstrate on-site spiral welding of a 160-m tower and installation of up-tower components with a tower-mounted self-hoisting crane.

Going forward, new blade and transport concepts could open up further market opportunities.

Tall orders

The Nordic region presents plentiful opportunities for onshore wind growth, benefiting from strong political and public support, relatively sparse population levels, and high levels of interconnection, Cambridge said.

«There is the opportunity to deploy market-leading technology and build projects of scale,” he said.

For the largest turbines, «the biggest opportunities may be in the North of Europe and Brazil,» Pedrosa said.

Siemens Gamesa’s latest turbine can also be shipped to US sites using existing transport structures, he said.

Wider deployment of larger turbine capacities could depend on permitting.

In the US, developers typically require special permission to build over 500 feet (152 m) in height, incurring higher costs, Barla said.

«If you want to go above that you would need special permission, and that can take up to nine months,» Barla said.

Ed Pearcey

Reposted from original source New Energy Update, Reuters Events